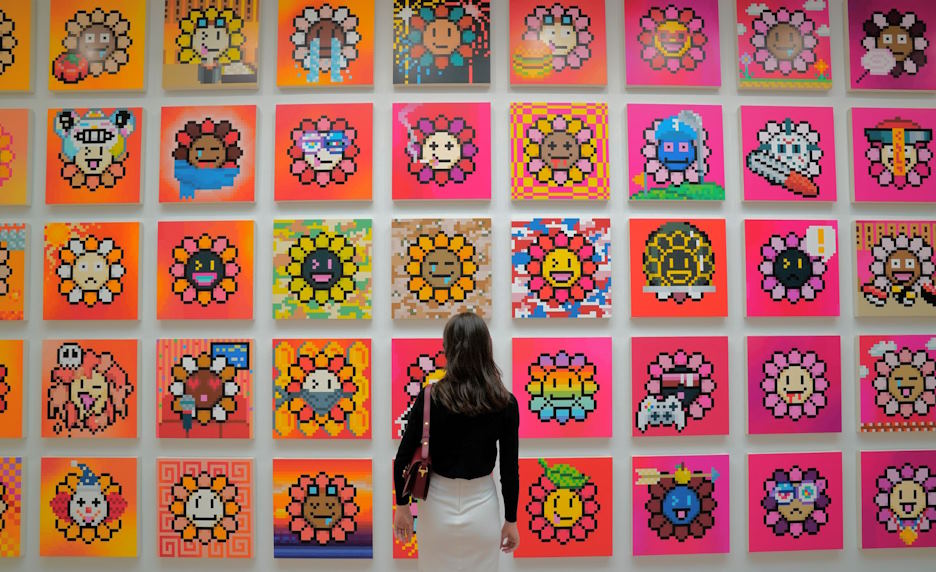

With the advent of blockchain technology, the digital world has witnessed an intriguing convergence of art, entertainment, and finance, giving birth to a new breed of collectibles: Celebrity NFTs. In essence, these tokens encapsulate the essence of fame, encapsulating iconic moments, artworks, and even personal interactions within the immutable confines of the blockchain. The past few years have witnessed an unprecedented surge in the popularity of NFTs, driven by factors such as their scarcity, the allure of digital ownership, and the endorsement of celebrities themselves. From sports legends immortalizing their greatest plays to renowned actors auctioning digital memorabilia, the concept of ownership has transcended the physical realm, finding a new home in the digital domain. As we journey deeper into the realms of investing in Celebrity NFTs, we unravel the layers of potential profitability and examine the risks that inevitably intertwine with these glamorous tokens of the digital age.

Investment Opportunities

Potential for High Returns

- Historical examples of successful celebrity NFT launches: Over the past few years, the NFT market has witnessed remarkable success stories that underscore the potential for high returns. Celebrities such as musicians, athletes, and artists have leveraged their influence to create exclusive digital collectibles, resulting in astronomical resale values. Iconic moments, limited edition artworks, and personalized experiences have commanded considerable prices, demonstrating the fervent demand for these unique tokens.

- Market demand and price appreciation: The surge in demand for Celebrity NFTs is a testament to their allure. As fans and collectors vie for a piece of their favorite celebrity’s digital legacy, prices have experienced notable appreciation. This trend is fueled by the scarcity inherent in NFTs – each token’s uniqueness ensures that owning it is an exclusive privilege. As the NFT ecosystem matures, the potential for price appreciation remains high, particularly for items linked to enduring stars with a dedicated fan base.

Diversification of Investment Portfolio

- NFTs as a new asset class: The emergence of NFTs has introduced a novel dimension to investment portfolios. These digital assets operate independently of traditional markets, offering diversification that can mitigate risks associated with stock market volatility. The NFT market’s growth potential is underscored by its unique nature – a decentralized ecosystem that is not directly tied to economic indicators.

- Balancing traditional investments with digital assets: Integrating Celebrity NFTs into a diversified portfolio can provide a hedge against conventional investment classes. Traditional investments like stocks and bonds might not capture the same level of emotional engagement and cultural relevance that NFTs offer. By strategically allocating a portion of funds to NFTs, investors can tap into both financial and emotional value, achieving a harmonious balance between tradition and innovation.

Accessible Investment Entry

- Lower investment thresholds compared to traditional markets: One of the distinctive features of Celebrity NFTs is their accessibility. While traditional investment avenues often demand substantial initial capital, NFTs enable participation with comparatively lower investment thresholds. This inclusivity allows a broader range of individuals to enter the investment space, democratizing wealth creation.

- Democratization of investing through NFT platforms: NFT platforms and marketplaces have simplified the investment process. Users can seamlessly browse, purchase, and trade Celebrity NFTs, often requiring only a digital wallet and an internet connection. This ease of access eliminates traditional barriers to entry, empowering investors of all backgrounds to engage with this exciting asset class. As NFT platforms continue to evolve and mature, the path to investing in Celebrity NFTs becomes increasingly user-friendly.

Key Considerations for Potential Investors

Thorough Research and Due Diligence

- Investigating the celebrity’s involvement and authenticity: Before delving into the world of Celebrity NFTs, diligent research is paramount. Ensure that the celebrity’s endorsement is genuine and legally binding. Scrutinize official announcements, social media confirmations, and reputable news sources to verify their association with the NFT project. Authenticity is the cornerstone of value in this realm.

- Evaluating the project’s development team and goals: The success of a Celebrity NFT project rests on the competence of its development team. Research the team’s experience in blockchain technology, NFT creation, and project management. Additionally, understand the project’s goals and long-term vision. A transparent and ambitious project roadmap can instill confidence in potential investors.

Risk Management Strategies

- Allocating a reasonable portion of the investment portfolio: While the allure of high returns is enticing, maintaining a balanced portfolio is essential. Allocate a reasonable portion of your investment capital to Celebrity NFTs, considering your risk tolerance and overall financial objectives. Diversification across various asset classes helps mitigate the impact of any single investment’s volatility.

- Setting limits and diversifying within the NFT space: Within the NFT realm, diversification remains critical. Instead of concentrating investments in a single Celebrity NFT, explore a variety of tokens across different celebrities and themes. This approach can reduce the risk associated with any individual NFT’s performance and provide exposure to a wider range of potential opportunities.

Long-Term vs Short-Term Outlook

- Aligning investment goals with NFT holding periods: Consider your investment horizon when entering the Celebrity NFT market. Some NFTs might yield quick gains due to initial hype, while others could appreciate over the long term. Align your investment goals with the NFT’s anticipated holding period, keeping in mind that speculative trends and sustained growth can both be part of this dynamic landscape.

- Recognizing potential for both quick gains and sustained growth: Celebrity NFTs can offer diverse outcomes. While short-term trading can yield rapid profits, adopting a long-term perspective allows you to capture the potential value appreciation of NFTs tied to enduring celebrity legacies. Balancing short-term trading strategies with long-term investment plans can offer a comprehensive approach to navigating the unpredictable NFT market.